Bank Secrecy Act Defines A Currency Transaction As

The idea of money laundering is essential to be understood for those working in the monetary sector. It's a course of by which soiled cash is converted into clean money. The sources of the cash in precise are felony and the cash is invested in a approach that makes it appear like clear cash and conceal the identity of the felony part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or maintaining current clients the obligation of adopting satisfactory measures lie on each one who is a part of the organization. The identification of such ingredient in the beginning is simple to take care of as an alternative realizing and encountering such conditions later on in the transaction stage. The central financial institution in any nation supplies complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such situations.

The first is interpretive guidance titled Application of FinCENs Regulations to Certain Business Models Involving Convertible Virtual Currencies. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC.

Bank Name Logo Employee Compliance Orientation Revised

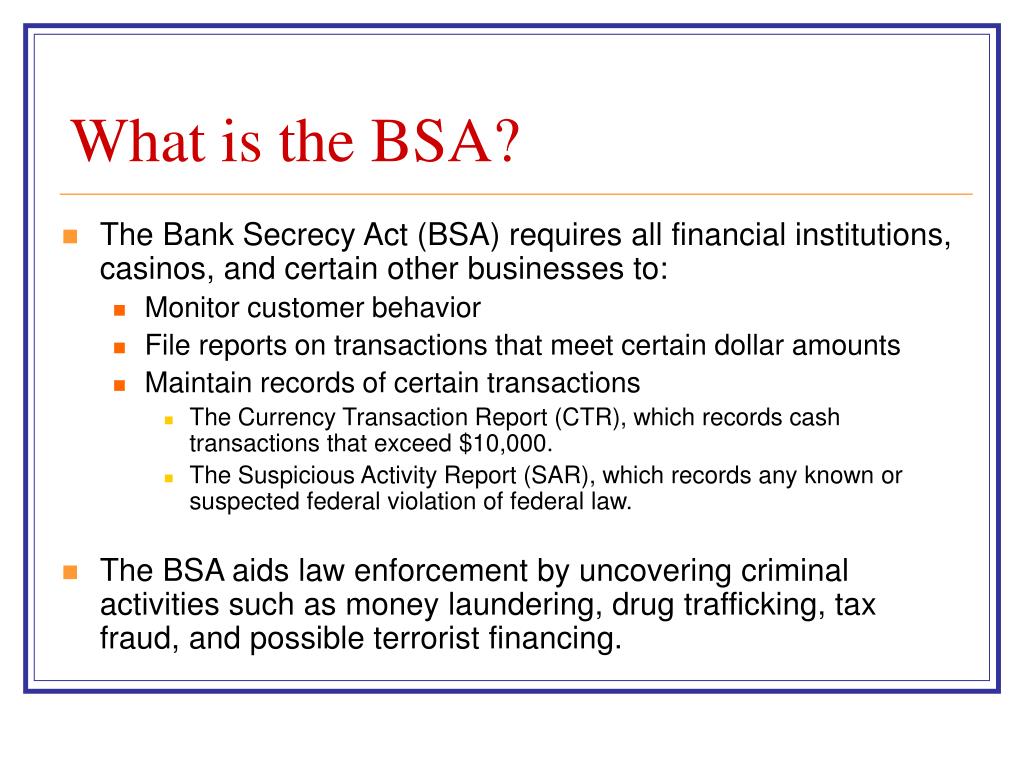

The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being used by criminals to hide their dirty money.

Bank secrecy act defines a currency transaction as. The reporting by financial institutions of transactions in currency in excess of 10000 has long been a major. Accordingly the transfer of currency below 10000 would not trigger the CTR requirement despite the amount of the check. All deposits of whatever nature with banks or banking institut.

Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. Government agencies in detecting and preventing money laundering such as. Under the Bank Secrecy ActBSA financial institutions are required to assist US.

BSA penalties depend on the type of entity the type of Anti-Money Laundering program reporting or. Also known as the Currency and Foreign Transactions Reporting Act the Bank Secrecy Act BSA is US. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a.

A bank must electronically file a Currency Transaction Report CTR for each transaction in currency deposit withdrawal exchange of currency or other payment or transfer of more than 10000 by through or to the bank. The authority of the Secretary to administer Title II of the Bank Secrecy Act has been delegated to the Director of FinCEN. Credits or deposits of money bullion security or other evide.

2 These currency transactions need not be reported if they involve exempt persons a group which can include commercial customers meeting specific criteria for exemption. 1 31 CFR 1010100m defines currency as coin and paper money of the United States or any other country that is designated as legal tender and that circulates and is customarily. On May 9 2019 FinCEN the US.

The regulations 26 CFR 16050I-1c Meaning of Terms define cash to include monetary instruments such as cashiers checks bank drafts travelers checks or money orders having a face value of not more than 10000 when received in a designated reporting transaction IRM 42610 Form 8300 History and Law and 26 CFR 16050I-1c1B1 or when received in any transaction in. 31 USC 5311 through 31 USC 5332 except 31 USC 5315 known as the Bank Secrecy Act BSA and the related regulations at 31 CFR Chapter X Financial Crimes Enforcement Network Department of the Treasury provide for civil and criminal penalties as well as forfeiture of assets. The second document is an Advisory on Illicit Activity Involving.

Under the Bank Secrecy Act US. 53115330 appear at 31 CFR Part 103. Filing Obligations A bank must electronically file a Currency Transaction Report CTR for each transaction in currency 1 deposit withdrawal exchange of currency or other payment or transfer of more than 10000 by through or to the bank.

The Currency and Foreign Transactions Reporting Act1 also known as the Bank Secrecy Act BSA and its implementing regulation 31 CFR 103 is a tool the US. Government uses to fight drug trafficking money laundering. Government in cases of suspected money laundering and fraud.

Banks are required to submit documentation for any transactions that add up to 10000 or more. TechTarget Contributor The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US. - sworn statement of unclaimed ba.

Currency is defined in BSA as the coin and paper money of the United States or any other country So no activity using private currency or cryptocurrency like Bitcoin would fit within the defined activities specifying currency as the medium for activity. Transaction to its members account. 3 Refer to the Transactions.

A transaction in currency involves the physical transfer of currency from one person to another. 5311 et seq is referred to as the Bank Secrecy Act BSA. Federal agency charged with combating money laundering issued two new interpretive documents of interest to the crypto community.

Currency The coin and paper money of the United States or of any other country that is designated as legal tender and that circulates and is customarily used and accepted as a medium of exchange in the country of issuance. Legislation created in 1970 to prevent financial institutions from being used as tools by. Title II of the Bank Secrecy Act codified at 31 USC.

Notes and Federal Reserve notes. Financial institutions to collaborate with the US.

Federal Register Proposed Collection Comment Request Bank Secrecy Act Currency Transaction Report Bank Secrecy Act Federal Register Proposal

What Is A Bank Secrecy Act Bsa Officer Tookitaki Tookitaki

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 1181717

Money Laundering Bank Secrecy Act Bsa

![]()

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download

Complianceonline Bank Secrecy Act Quiz Proprofs Quiz

Bank Secrecy Act Understanding Its Reporting Requirements

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers

Bank Name Logo Employee Compliance Orientation Revised

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 1181717

The world of rules can appear to be a bowl of alphabet soup at times. US money laundering regulations are no exception. We've got compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting agency focused on defending financial providers by decreasing risk, fraud and losses. We have now big bank experience in operational and regulatory threat. We've a powerful background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many adverse consequences to the group due to the risks it presents. It increases the probability of major dangers and the chance value of the financial institution and finally causes the bank to face losses.